News

How FIRS Plans To Realise Its Revenue Target -Fowler

The Federal Inland Revenue Service (FIRS) says it plans to realize its revenue target for the year through recoveries from defaulting millionaire taxpayers, values added (VAT) and compliance enforcement activities.

The Chairman of FIRS, Tunde Fowler, said in January that the agency’s revenue collection target for 2019 was about N8 trillion.

Mr Fowler told the House of Representatives joint committees on Finance, Appropriations, Aids, Loans and Debt Management Legislative Budget and Research and National Planning and Economic Development that he hopes about N750bn would be realized from about 55,000 defaulting taxpayers during the year.

Mr Fowler, who spoke on the 2019/2021 Medium Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP), said using banking information to bring non-compliant taxpayers with N1 billion and above turnover to comply about N23.25 billion has been recovered so far.

He also restated that 85% of VAT collected goes to State Governments. He said the exercise has been extended to cover those with turnover of N100 million and above.

“To date, about 500 of the tax defaulters have come forward and have paid about N24 billion. We believe we should be able to go through the 55,000 before the middle of this year.

“In terms of estimates we should be able to be able to generate from this exercise alone about N750 billion.”

Besides, Mr Fowler said the FIRS also expects that the increase in Value Added Tax (VAT) collection between 2015 and 2018 will continue during the year.

He said FIRS is already broadening its VAT collection scope with the adoption of States Accountants Generals (SAG) collection platform, VAT Auto-Collect, integration of the GIFMIS platform with Ministries, Departments and Agencies, (MDAs) and through e-Service payment options.

Out of about N5.3 trillion, a large percentage of the revenue is shared between states and local governments.’ In VAT, there has been a growth of over 44 per cent between 2015 and 2018 at the current rate of 5 percent.

“When you look at Africa as a continent, Nigeria still has the lowest VAT rate. When we look at the items that do not attract VAT, they include basic food items, medicals, and education.

Insisting VAT is not for the poor, Mr Fowler said if one is able to go to a restaurant to eat and drink the same thing one can buy in the open market, then one can pay VAT.

“So, VAT basically is a consumption tax, and those who choose not to go to the open market to buy their food and cook at home are subject to VAT. So, VAT is not a hardship on the low income earners.

“For those who have the ability and the desire to take the choice of going to areas where they have to pay VAT, then they should be allowed to pay VAT,” he added. He said revenue collection by FIRS increased by about 32 per cent from N4.02 trillion in 2017 to N5.3 trillion in 2018.

The FIRS Chairman told the committee that through enforcement activities in respect of defaulting taxpayers from various tax offices, tax audit and investigation assessments, the agency recovered about N28. 51 billion and $77. 83 million.

Also, the FIRS is partnering with the Economic and Financial Crimes Commission (EFCC) and Joint Tax Force (JTF) since 2018 to enhance the fight against tax related economic fraud. As at December 2018, he said about N6. 94 billion and $278,430 had been recovered by the JTF as part of initiatives to boost revenue generation.

To deepen tax revenue collection and expand the nation’s tax net as well as increase the revenue base, Mr Fowler said the FIRS also initiated income tax on property owners in Abuja and Lagos.

He said the initiative, which was initially targeted at property owners in Abuja and Lagos, has so far yielded N4.3 billion, and is being extended to other locations like Oyo and Kaduna states.

“It is important to note that this is not a property tax, but rather the use of the provisions of the law to bring into the tax net companies that own properties but failed to file necessary tax returns and pay appropriate taxes due,” Mr Fowler said.

On tax audit exercise of the Service, the FIRS boss said this will cover both the National Tax Audit (NTA) and the Pioneer Audit (PA). The NTA exercise contributed the sum of N212.79 billion to tax collection in 2018.

Celebrities

DNA SAGA: Actor Yomi Fabiyi Writes Mohbad’s Widow; Wumi Aloba

Dear Wunmi,

A DNA CAN BE REQUESTED BY MOHBAD’S FAMILY

I share in your family’s pain in the loss of Mohbad. May God forgive his sins. I am writing you based on the prolonged arguments on the issue of DNA concerning Mohbad’s son and ongoing investigation into the actual cause of his death.

The following reasons are why you can be compelled for a DNA TEST by Mohbad’s family:

i) From the look of things, Mohbad’s death is tilting towards “HOMCIDE” owing to events that happened in the last 48 hours before the singer d1ed. The coroner inquest is an investigation and needs closure before charges.

ii) In a saner cline, those around the deceased, those who tampered with the active crime scenes, are SUSPECTS and should have been taken in for questioning, which include you.

iii) If there is evidence/accusation of infidelity around the time of conception against you or re-occuring domstic violnce (and no clear reasons for conflicts), chances are the cause is due to paternity Only a DNA test can vindicate you, dear. It’s your advantage.

iv) if Liam will inherit the late singer’s estate and the likely cause of his muder is within the house, the family as a legally interested party can ask you honourably or through the court to conduct a DNA before you can be allowed custodian of their son’s properties on behalf of LIAM, etc. Moreso, the DNA will help investigators narrow their drag nets. NO ONE SHOULD OBSTRUCT POLICE or CORONER’S INVESTIGATION.

v) Mohbad, in an unverified audio released, equally accused you of wanting to kll him. No one knows if it is the normal couples’ fight or if it was due to any other sensitive issue.

vi) Anything that will bring clarity, absolve you of any wrongdoing, erase suspicion around you, get justice for Mohbad should interest you,including a DNA TEST.

vii) Your continued back and forth is an attempt to infuriate members of the public and pitch irrates youths against the Police and government. No sooner, people will conclude that someone powerful is shielding you. And that person can’t be more powerful than a determined masses.

News

JUST IN: “I Know That Liam Is My Grandson, I Don’t Doubt It, But Wunmi Should Do The DNA For The Sake Of Nigerians To Know That Liam Is Mohbad’s Son” — Baba Mohbad Says

News

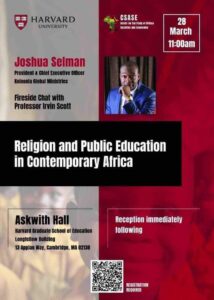

Harvard University To Hosts Apostle Joshua Selman

Harvard University’s Center for the Study of African Societies and Economics (CSASE) is set to welcome Apostle Joshua Selman, the esteemed founder of Koinonia Global Ministries, for a compelling lecture titled “The Role of Religion in Resilient Societies: Lessons from Africa’s Development Journey.”

Scheduled for Tuesday, March 26th, 2024, from 12:00pm to 1:30pm, the event will take place at the renowned Harvard Divinity School. Apostle Joshua Selman’s lecture promises to shed light on the vital role of religion in shaping resilient societies, drawing from Africa’s unique developmental trajectory.

Attendance requires registration due to the exclusivity of the occasion. Following the lecture, attendees will have the opportunity to participate in a reception aimed at fostering deeper engagement and dialogue.

Harvard University invites all interested individuals to join Apostle Joshua Selman for an enlightening conversation that seeks to challenge perceptions and inspire new insights into the relationship between faith and social progress.

-

News6 years ago

Blog Reader; Samson Osagiede Celebrates Fiancè Benedicta Daniels’s Birthday With Sweet Words

-

Home7 years ago

News Channel claims Donald Trump is an orphan from Pakistan,share alleged childhood photo

-

Home7 years ago

Oil Spillage: House of Reps Member Shares Photos of the Water her Constituents Drink .

-

Home7 years ago

Another $175m Found in Patience Jonathan’s wife’s firm’s Bank Account

-

Home7 years ago

Zara Buhari & Ahmed Indimi’s Wedding Access Card

-

News6 years ago

The Best Video You’ve Seen Today?

-

Sport6 years ago

Sport6 years agoModric, Marta Wins 2018 FIFA Best Player Of The Year Awards ⚽️

-

News4 years ago

I Rαped Over 40 Women In One Year” – Says Kano Serial Rapist Who Was Caught In A Child’s Bedroom